New research from Interact Analysis shows that just under 7,300 automated micro-fulfilment centres (MFCs) will be installed by the end of 2030, up from just 86 at the end of 2021. Growth in the short-run will mainly driven by demand for same-day grocery delivery.

In the near future, much of the growth in the automated MFC market will come from the large incumbent grocery retailers, such as Walmart and Tesco, as they strive to offer same-day delivery services. Conversely, demand from non-grocery retailers is far smaller due to a slower uptake of same-day deliveries. The research defines automated MFCs as fulfilment centres smaller than 50,000ft2, or as automation installed in the back of a store. And it splits potential customers into two categories – grocery (where more than 50% of revenues is from grocery), and non-grocery retailers.

Additionally, the rapid-delivery companies have so far been slow in deploying automated MFCs. That’s because they’ve been focusing more on network expansion and customer acquisition rather than driving operational efficiency through automation. However, the rapid delivery market will likely undergo a period of consolidation in the coming years which will lead to a strong focus on profitability per delivery site – and investment in automation.

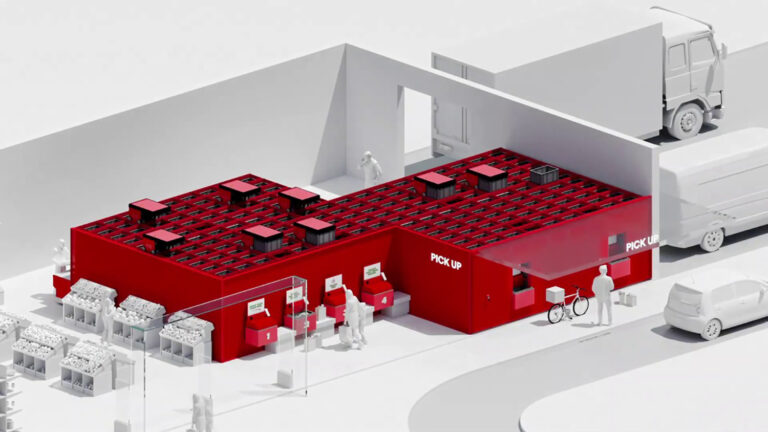

Of the total installed base of 86 automated MFCs at the end of 2021, Takeoff Technologies accounted for 23%. It was one of the first companies to offer automated MFC solutions, allowing it to gain a substantial market share. Following closely behind, Swisslog (main picture) accounted for 21% of installed projects by the end of 2021. Swisslog is now working with HEB and others to install AutoStore systems in MFCs across the USA. Meanwhile, Dematic accounted for only 14%. However, this is likely to increase significantly as a result of their collaborations with Walmart and Tesco.

“There’s no doubt that the growth in the automated MFC market has been slower than expected,” said Rueben Scriven, Senior Analyst at Interact Analysis. “This is partly driven by supply chain constraints and permitting delays, although Instacart’s white-label services are also calling into question the need for in-house fulfilment assets for some grocers. However, while incumbent grocers have been slower to adopt automated MFCs, the phenomenal growth of rapid delivery companies and the q-commerce market has significantly increased the addressable market, driving future growth.”