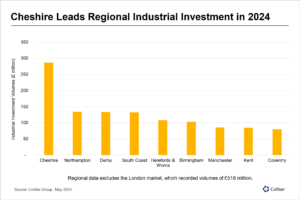

Cheshire in North West England has emerged as the leader in industrial investment volumes for 2024, outpacing all other regions outside of London.

According to CoStar’s latest data covering 53 markets, investment volumes in the North West market, spearheaded by Cheshire, have soared to £286 million this year. This figure more than doubles that of any other regional market, including the well-known Golden Triangle logistics hubs of Northampton and Coventry. The surge in Cheshire’s investment volumes is reportedly primarily attributed to three major deals, each exceeding £50m, in the northern part of the county. This area has proven to be a prime location for industrial investment as it’s located at the intersection of the M56, M62, and M6 motorways between Warrington and Widnes.

The surge in Cheshire’s investment volumes is reportedly primarily attributed to three major deals, each exceeding £50m, in the northern part of the county. This area has proven to be a prime location for industrial investment as it’s located at the intersection of the M56, M62, and M6 motorways between Warrington and Widnes.

A significant driver behind this investment boom is a joint venture between American global investment firms KKR and Mirastar. This partnership seemingly played a pivotal role in two of the major deals, including the largest transaction in March – the acquisition of Omega II in Warrington. Purchased from Mountpark and USAA for approximately £110m, this deal included three BREEAM ‘Excellent’ logistics and distribution assets spanning 736,500ft2.

The attractiveness of the North West market, recognised by buyers as one of the UK’s top-performing regions, is underscored by its robust supply-demand dynamics, population growth and above-average rental growth prospects. In January, the KKR and Mirastar joint venture also forward-funded the development of Marshall CDP’s 550,000ft2 X-Dock545 in Widnes for around £65.4m. This deal was part of KKR’s Real Estate Partners Europe II fund, which targets ‘value-add and opportunistic real estate investments in Western Europe’.

Further highlighting confidence in the region, the joint venture was involved in the development of three large warehouses at Gorsey Point, Widnes, later sold to Clarion Partners last year.

Beyond Cheshire, other regions also saw significant industrial investment activity. Northampton, for example, secured the second-highest investment volumes according to CoStar. Clarion Partners continued its investment streak, acquiring nine mid-box properties on two estates in Kettering and Redditch from Tristan Capital Partners for £80.5m.

The South Coast emerged as the most active market in the South East, with notable deals in Fareham. The largest transaction involved Royal London Asset Management’s purchase of the 24.1-acre vacant Abbey Works site for £30.2m, earmarked for redevelopment for aerospace company Eaton, with a total development value of approximately £140m.

While regional markets performed robustly, excluded from the regional results, London maintained its dominance in overall volumes, recording £518m in investments. The largest deal in May saw Royal London Asset Management selling the 33.6-acre International Trading Estate in Southall, West London, to Global Technical Realty for £315m, a move set to transform the site into a data centre redevelopment.

Despite these significant transactions, the UK’s industrial investment volumes have generally remained subdued. The first quarter of this year saw £1.6 m in trading, with figures rising to £2.5m by the end of May. This compares to £2.5m in the first quarter of 2023 and £5m in the same period the previous year.