The Society of Motor Manufacturers and Traders (SMMT) has called on the UK government to work with industry to develop a plan that facilitates the transition to zero-emission HGVs, before it commits an end-of-sale date for conventionally fuelled trucks.

All of Europe’s major truck manufacturers have agreed that new HGVs will be fossil fuel-free by 2040, and are investing billions in new powertrains to replace diesel, the most commonly used HGV fuel. However, at present there is no clear technology that can provide full zero-emission operations for all weights and uses of HGVs.

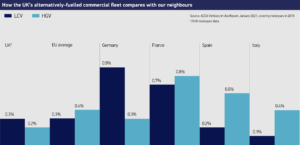

The need to support powertrain research and infrastructure development has been underlined by a new report published today, Fuelling the Fleet: Delivering Commercial Vehicle Decarbonisation. SMMT analysis has revealed that the commercial, technological and operational barriers currently associated with new technologies such as batteries and hydrogen meant that in 2020, only 0.2% of HGVs were alternatively fuelled – contrasted with cars, which reached this proportion in 2007.

Battery electric van usage, meanwhile, reached 0.3% in 2020 – the same proportion as cars in 2019. Uptake rates for electric vans have continued to grow rapidly, reflecting how battery power can effectively replace fossil fuels in this vehicle class, but just 2.6% of new vans registered between January and July 2021 were battery electric vehicles (BEVs), compared to 8.2% of cars.

Established manufacturers have already brought a range of fossil fuel-free HGVs and vans to market, while several new players have also entered the market with dedicated zero-emission commercial vehicle portfolios. With new technology comes new opportunities and the UK, as a manufacturer, of vans, trucks and other HGVs must accelerate the transition to fossil fuel free commercial vehicles and their component parts. To achieve this, government should develop a roadmap that supports UK manufacturers and the supply chain, creating a strong domestic market and helping companies seize the opportunities that emerge.

Infrastructure is acting as one of the biggest barriers to uptake. The UK needs a dedicated public HGV charging network, as only operators who can afford to invest in expensive depot infrastructure and operate on a back to base model can currently make the switch. This network needs to be rolled out urgently – ACEA forecasts that by 2030, the UK will need 8,200 public HGV charging points, equivalent to more than two new charge points opening every single day until the end of the decade. Alternative technological solutions, such as hydrogen fuel cell vehicles, face an even tougher challenge with only 11 refuelling locations across the country.

Decarbonising the commercial vehicle sector will therefore need more support from government and other stakeholders outside the automotive industry. New technologies need new skills, so the workforce that maintains these essential vehicles must have access and support for the training courses essential to high voltage and other system work. Above all, the industry needs a stable, long-term regulatory and fiscal strategy to deliver a vibrant zero emission HGV market so that manufacturers and operators can confidently plan and prepare for the future.

“The industry is committed to be fossil fuel-free, but there is not yet a clear technology path for every weight class and every use case,” said Mike Hawes, SMMT Chief Executive. “Before it sets a deadline for the sector, the government must support the technological development and market proposition and provide the right framework, so hauliers don’t defer their decarbonising decision to the last minute. Plans before bans is the key.

“Vans face fewer obstacles in this decarbonisation journey than HGVs but adoption rates remain low, driven by the lack of charging points and higher operating costs relative to diesel. The new models are there, with many more coming, but without investment in incentives and infrastructure, the commercial vehicle sector will struggle to meet our shared ambition to reach net zero.”