FirethornTrust has agreed a £22m debt facility with Federated Hermes to finance the construction of a 325,000 sq ft logistics scheme at Milton Ham, near Northampton.

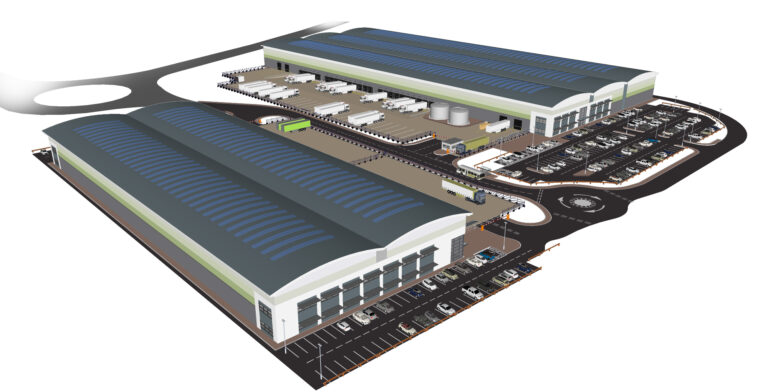

The 37-acre site was acquired from Travis Perkins at the end of last year and has planning consent for three units; one of 220,000 sq ft, and two of 52,000 sq ft.

FirethornTrust plans to develop the scheme speculatively and will start on site in H2 2020 with a view to delivering the first units by the end of H1 2021.

The site sits within the UK industrial market’s “golden triangle” just off Junction 15a of the M1 and adjacent to Prologis’ Pineham Park. This was FirethornTrust’s first acquisition in the industrial arena, which was shortly followed by the acquisition of Apex Park near Bedford, bringing its total development pipeline to over of 750,000 sq ft.

The site sits within the UK industrial market’s “golden triangle” just off Junction 15a of the M1 and adjacent to Prologis’ Pineham Park. This was FirethornTrust’s first acquisition in the industrial arena, which was shortly followed by the acquisition of Apex Park near Bedford, bringing its total development pipeline to over of 750,000 sq ft.

The development financing is being provided by Federated Hermes’ Real Estate Debt Fund.

Richard Whitby, chief financial officer at FirethornTrust, said, “Although we are operating in uncertain times, we remain committed to our core focus on the mid-box market and producing much-needed grade-A warehouse space.

“The quality of this product coupled with the strategic location of the site lends itself to a variety of industrial and logistics operators. We had significant interest from multiple lenders but we are delighted to have agreed this loan facility with Federated Hermes who share our vision for the project.”

Ben Patton, head of real estate debt at Federated Hermes, added: “Despite the challenging market conditions, we continue to see attractive funding opportunities in certain markets. Milton Ham presents an excellent opportunity to develop Grade A space in a key location and into a market with proven long-term occupier demand.”

FirethornTrust was advised by JLL and Stephenson Harwood while Federated Hermes was represented by Paragon and BCLP.