Knight Frank’s latest research predicts that the increase in online shopping will fuel an additional demand of 12 million ft2 for urban warehouse space by 2025.

E-commerce sales are forecast to rise from 27% to 30% by 2025, resulting in an additional £37 billion worth of online retail sales. With every billion pounds of online retail sales requiring around 320,000ft2 of urban logistics space, this could drive 12 million ft2 of additional last-mile fulfilment space requirements.

Knight Franks analysis of hub and spoke networks servicing online retail found that 23.5% of space is allocated to “spoke” facilities that are servicing last mile deliveries, and demand for these facilities is expected to grow as online shoppers demand faster delivery times, requiring logistics operators to hold stock closer to consumers.

Demand for urban logistics units has driven down vacancy rates sharply in urban areas. Across the UK, the vacancy rate for units under 100,000ft2 in urban locations is just 3.2% and is expected to fall further. In Greater London, the vacancy rate for units under 100,000ft2 is just 3.1%, in Bristol it stands at just 1.5% and in Edinburgh, Birmingham, and Manchester, vacancy rates are less than 1%. This compares with a vacancy rate of 5% across the UK, for all unit sizes over 50,000ft2.

Charles Binks, Partner, Head of Industrial & Logistics at Knight Frank, commented: “The surge in demand for urban logistics space has been mainly fuelled by ecommerce growth, but also the need for supply chain resilience. While ‘just-in-time’ supply chains limit the need for storage and thus reduces the need for warehousing space, the pandemic highlighted issues with this model as global supply chains were shut off. As a result, we have seen a re-shoring or near-shoring of operations, with occupiers moving facilities closer to the end consumer.

Claire Williams, Industrial Research Lead at Knight Frank, added: “With consumers demanding faster delivery times, retailers and logistics operators are pushing to improve their distribution models, reduce inefficiencies, and hold stock closer to consumers. The growth in the on-demand grocery delivery market has given rise to several new companies offering deliveries within a matter of minutes. This has intensified competition for space, which is driving up rents given that vacancy rates in urban locations are at historic lows.

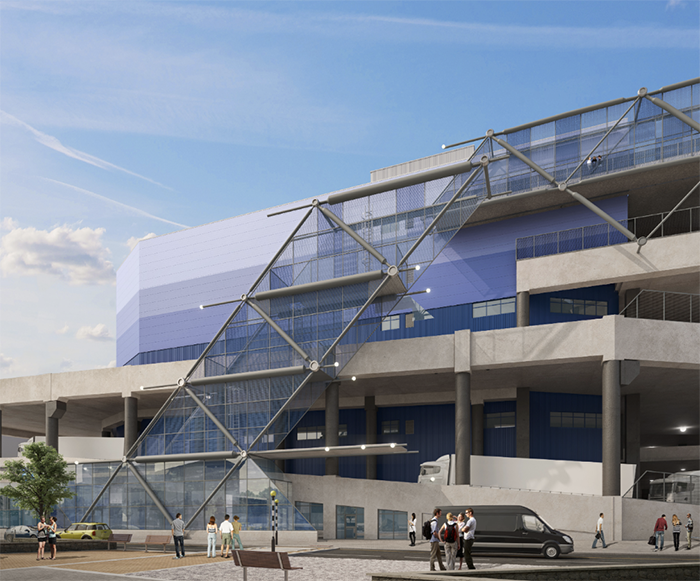

Based on our analysis of hub and spoke networks, the forecast for online sales over the next five years, could mean additional requirements for last-mile fulfilment totalling 12 million ft2 – the equivalent of 16 Wembley stadiums. But meeting that level of demand in the locations where it is needed seems unrealistic. Availability in urban areas remains highly constrained and rents are rising. Instead, retailers and logistics operators are having to look at creative ways to repurpose properties to service last mile fulfilment, or at ways to improve their operational efficiencies and use of space, through automation.”

The lack of space and development opportunities is driving strong rental growth for industrial assets across urban areas, with particularly strong growth being recorded in London and the South East region. Across the UK, Sheffield has the highest rental growth forecast of this year, with annual growth of 7.8%.

In London, the east London boroughs of Newham and Tower Hamlets, along with south London boroughs of Merton and Southwark top the list, all of which are expected to record more than 7% rental growth this year.